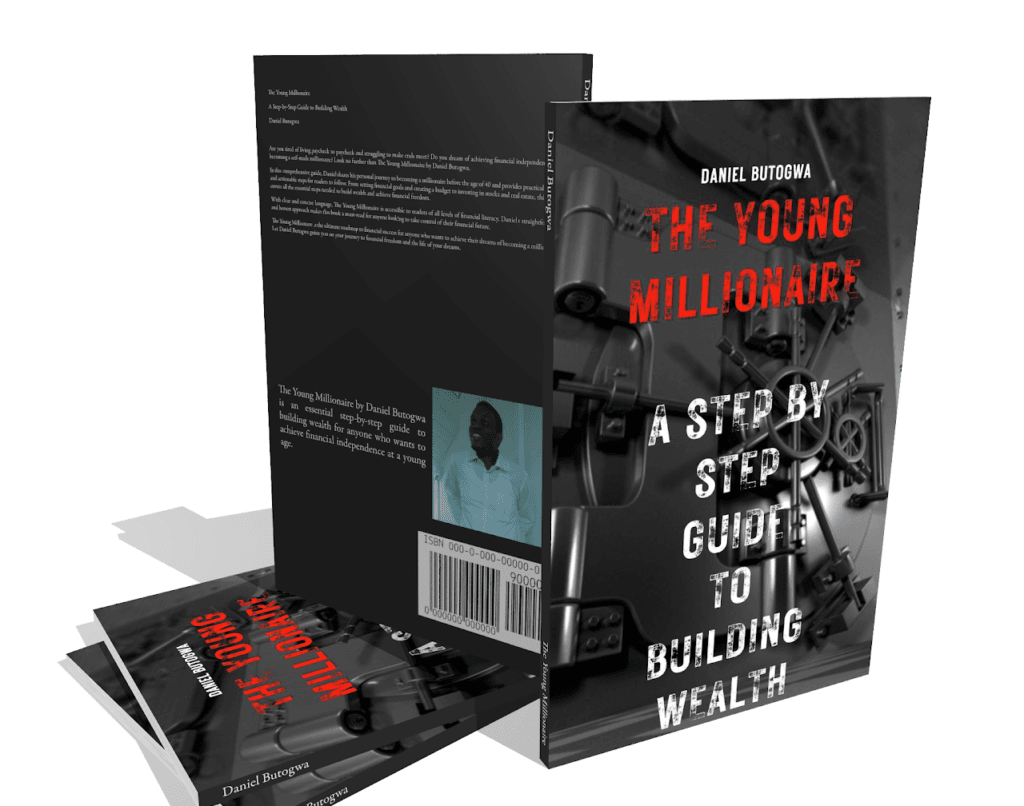

Download The Young Millionaire Here

Looking to achieve financial freedom and build wealth? One of the best ways to start your journey is by reading books that offer proven strategies and real-life advice. Books on how to become a millionaire can equip you with the knowledge you need to succeed. From timeless classics to modern-day insights, these books provide invaluable lessons on mindset, wealth-building strategies, and practical steps for financial independence. In this post, we’ll explore some of the best resources available, including “The Young Millionaire“ by Daniel Butogwa, a book that offers actionable advice for young entrepreneurs.

Best Books on How To Become a Millionaire

If you’re on a journey to financial success, finding the right resources is key. Books on how to become a millionaire provide a wealth of knowledge from experts who have walked the path to success. These books offer practical strategies, mindset shifts, and real-life examples of wealth-building that can inspire you to take action.

When looking for books on how to become a millionaire, you’ll find a variety of options, from classic financial wisdom to modern takes on entrepreneurship and wealth management. Some books focus on practical investment strategies, while others highlight the importance of mindset and perseverance.

A few standout titles in this category include:

- “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko – This classic book explores the habits and lifestyles of real millionaires, showing that many achieve wealth through simple, disciplined living.

- “Think and Grow Rich” by Napoleon Hill – A timeless guide to success that emphasizes the power of thought, persistence, and goal setting.

- “Rich Dad Poor Dad” by Robert Kiyosaki – This modern bestseller teaches financial literacy through personal stories, focusing on the difference between assets and liabilities.

Among these books, one recent standout is “The Young Millionaire“ by Daniel Butogwa. This book provides actionable advice for young entrepreneurs looking to create multiple streams of income and achieve financial freedom. Butogwa shares his personal journey and offers a step-by-step guide to building wealth, making it a great addition to your must-read list for financial success.

By reading these books, you can gain valuable insights on how to develop a millionaire mindset, build wealth, and create financial independence.

Why Reading is Key to Financial Success

Reading is one of the most powerful tools for anyone looking to achieve financial independence. Books offer insights from successful individuals who have navigated the complexities of wealth creation. The knowledge gained from books on how to become a millionaire can help readers avoid common mistakes, adopt successful habits, and accelerate their financial journeys.

A major benefit of reading these books is that they provide access to the experiences and strategies of millionaires. Whether you’re learning about investment principles, the psychology of money, or entrepreneurial tactics, each book offers a blueprint that can be customized to fit your personal financial goals.

Books like “The Millionaire Fastlane“ by MJ DeMarco, “Your Money or Your Life” by Vicki Robin and Joe Dominguez, and “The Young Millionaire“ by Daniel Butogwa teach not only the mechanics of money management but also the mindset necessary for wealth accumulation. For example, Butogwa emphasizes the importance of creating multiple streams of income and developing a long-term wealth-building strategy, particularly for young adults.

Ultimately, reading helps you stay informed, motivated, and ready to take actionable steps towards financial success.

Traits of Millionaires from Top Books

One of the key takeaways from books on how to become a millionaire is that building wealth often boils down to certain key traits and habits. Successful millionaires, as documented in popular financial literature, tend to share similar characteristics that contribute to their financial success.

Discipline and Consistency are recurring themes. Books like “The Millionaire Next Door“ highlight that many millionaires live below their means and consistently save and invest over long periods. Similarly, in “The Young Millionaire,” Daniel Butogwa emphasizes the need for discipline when pursuing financial freedom, pointing out that consistent effort is key to achieving wealth early in life.

Risk-taking with Calculated Decisions is another common trait. Many millionaires are willing to take risks, but they do so with informed, calculated strategies. Books like “Rich Dad Poor Dad” focus on making smart investments, particularly in assets that grow over time, such as real estate and businesses. Butogwa’s approach in “The Young Millionaire” mirrors this, as he discusses creating multiple streams of income by venturing into opportunities like entrepreneurship and passive income investments.

Continuous Learning and Growth is essential. Millionaires are lifelong learners. Many of the best books on how to become a millionaire stress the importance of adapting to new knowledge, markets, and opportunities. Butogwa’s journey is an excellent example of self-improvement, turning his personal challenges into motivation for financial success and sharing that knowledge with others.

Understanding and cultivating these traits, as described in these books, can significantly enhance your ability to achieve financial independence.

Classic Millionaire Books

When it comes to books on how to become a millionaire, classic titles have stood the test of time for a reason. These books offer fundamental lessons on wealth-building, providing insights that are as relevant today as when they were first published.

One of the most well-known is “Think and Grow Rich” by Napoleon Hill, a cornerstone in the personal finance and self-development world. Published in 1937, this book emphasizes the power of positive thinking, goal-setting, and persistence. Hill studied hundreds of millionaires to uncover the common traits that led to their success, and his principles remain highly influential for aspiring millionaires.

Another essential classic is “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko. First published in 1996, this book dispels the myth that most millionaires live lavish lifestyles. Instead, it shows how the majority of millionaires practice frugality, consistently save and invest, and avoid debt. Their habits of financial discipline are crucial lessons for anyone looking to build wealth.

These classics offer timeless strategies and a foundational understanding of what it takes to achieve financial independence. Whether you’re a seasoned investor or just starting your financial journey, these books serve as a vital resource. “The Young Millionaire“ by Daniel Butogwa can be seen as a modern complement to these classics, offering up-to-date advice and actionable steps tailored for today’s aspiring young entrepreneurs. By combining lessons from both classic and modern titles, you can create a powerful strategy for wealth-building.

Modern Wealth Books for Today

In the ever-evolving landscape of finance and entrepreneurship, modern books on how to become a millionaire provide up-to-date strategies that are crucial for today’s generation. These books often focus on topics such as digital entrepreneurship, side hustles, and leveraging technology to build wealth.

One notable modern book is “The Millionaire Fastlane” by MJ DeMarco, which challenges the conventional slow-and-steady approach to wealth-building. DeMarco advocates for creating high-value businesses that allow for faster wealth accumulation. His unconventional but practical advice resonates with younger readers looking for quicker paths to financial success.

Similarly, “The 4-Hour Workweek“ by Tim Ferriss revolutionized the way people think about work and wealth. Ferriss introduces the concept of “lifestyle design” where individuals create businesses that allow for financial freedom and flexible work hours, enabling them to enjoy life while still building wealth.

In the same vein, “The Young Millionaire“ by Daniel Butogwa provides modern, actionable steps for achieving financial independence, particularly for young entrepreneurs. Butogwa focuses on creating multiple streams of income, using digital tools, and investing wisely to grow wealth at a young age. His approach is practical for today’s fast-paced and interconnected world, offering insights that align with current trends in digital business and financial literacy.

These modern books provide the tools and strategies needed to succeed in today’s economy, making them valuable reads for anyone aiming to become a millionaire in the digital age.

The Power of Mindset in Wealth Creation

One common theme in books on how to become a millionaire is the importance of mindset. Many financial success stories start with a shift in how individuals think about money, wealth, and opportunities. A millionaire mindset involves developing beliefs and habits that drive long-term financial success, such as persistence, optimism, and the ability to take calculated risks.

Books like “Think and Grow Rich” by Napoleon Hill emphasize the role of mental attitude in achieving wealth. Hill argues that having a clear vision of success, combined with unwavering belief and consistent action, is crucial for becoming financially independent. This mindset-oriented approach is echoed in other works like “The Power of Positive Thinking” by Norman Vincent Peale, which teaches readers to harness the power of optimism to reach their financial goals.

In “The Young Millionaire,” Daniel Butogwa also stresses the importance of a wealth-building mindset. He shares his personal story of overcoming financial hardship and how changing his mindset allowed him to turn obstacles into opportunities. Butogwa provides practical advice on how to stay motivated, avoid self-doubt, and continuously strive for success.

Ultimately, the mindset shift from scarcity to abundance is essential for anyone aiming to become a millionaire. By cultivating a belief in your ability to create and grow wealth, you can take the first steps toward achieving financial freedom. These books highlight that the journey to becoming a millionaire starts in the mind.

Wealth-Building Strategies from Books

Wealth-building is not just about earning money; it’s about strategically managing and growing that wealth over time. Many books on how to become a millionaire provide readers with detailed strategies to achieve this, from mastering investments to creating multiple streams of income.

In “The Millionaire Next Door”, Thomas J. Stanley and William D. Danko emphasize frugality and consistent investing as key strategies for long-term wealth. Their research found that many millionaires live below their means, invest wisely, and avoid unnecessary debt. This approach is often referred to as “slow and steady,” but it’s proven to be highly effective for wealth accumulation.

Other books, like “Rich Dad Poor Dad” by Robert Kiyosaki, advocate for smarter financial literacy, particularly understanding the difference between assets and liabilities. Kiyosaki stresses the importance of acquiring income-generating assets, such as real estate or stocks, to build passive income streams that grow over time.

In more modern titles like “The Young Millionaire“ by Daniel Butogwa, the focus shifts to creating diverse income sources, especially through entrepreneurship and digital platforms. Butogwa provides readers with a clear roadmap for leveraging new opportunities, such as online businesses, to accelerate wealth-building. He highlights the importance of seizing opportunities in emerging markets and industries while maintaining a disciplined investment strategy.

By combining practical strategies from these books, readers can develop a personalized plan for financial independence. Whether it’s building passive income, investing wisely, or starting a business, these wealth-building strategies are essential tools for anyone looking to become a millionaire.

Why “The Young Millionaire” is Unique

The Young Millionaire by Daniel Butogwa stands out in the crowded field of books about wealth-building for several key reasons. Unlike many classic or modern finance books that focus on general principles, Butogwa provides a focused, actionable roadmap specifically tailored for young adults seeking financial independence.

First, Butogwa’s personal journey adds a unique perspective to the book. Having grown up facing poverty and adversity, he offers practical advice rooted in real-life experiences. His approach isn’t just theoretical; it’s based on what worked for him and many other young entrepreneurs. This makes the advice in “The Young Millionaire“ relatable and attainable for readers just starting their financial journey.

Second, Butogwa emphasizes the importance of building multiple streams of income, a concept that has gained significant relevance in today’s gig economy and digital-first world. While other books like “Rich Dad Poor Dad” (Robert Kiyosaki) or “The Millionaire Fastlane” (MJ DeMarco) advocate for investing in assets like real estate or businesses, Butogwa explores additional avenues, such as online businesses, side hustles, and digital marketing. His guidance is especially relevant for young people looking to leverage technology and online platforms to create wealth quickly.

Moreover, Butogwa’s book is highly practical. Each chapter breaks down essential concepts in easy-to-understand language, making it accessible for anyone, regardless of their financial background. Unlike many books that leave readers with vague inspiration, “The Young Millionaire” provides specific, actionable steps that can be immediately implemented.

In a world where financial literacy is more important than ever, Butogwa’s unique approach is helping young people learn how to achieve financial independence. Whether you’re just starting out or looking for a new way to approach wealth, this book provides both the inspiration and the tools needed to succeed in today’s fast-moving economy.

Success Stories in “The Young Millionaire”

One of the most powerful aspects of “The Young Millionaire“ is its inclusion of success stories that inspire and motivate readers. These real-life examples not only highlight the principles discussed in the book but also demonstrate how young individuals can achieve financial independence despite challenges.

Daniel Butogwa shares his personal story, which serves as the backbone of the book. From facing rejection and financial struggles, Butogwa transformed his life through sheer perseverance, learning the principles of wealth creation, and applying them step by step. His story is particularly compelling for young readers, showing that financial freedom is achievable even if you’re starting from scratch.

Additionally, Butogwa includes success stories of other young entrepreneurs who have built their wealth through innovative business models and strategic investments. These stories highlight the diversity of paths to financial success, such as building an online business, investing in the stock market, or creating passive income streams through digital products. For example, he discusses how certain individuals used the power of social media marketing to scale businesses quickly, a strategy that aligns with today’s tech-savvy world.

The inclusion of these success stories is essential because it makes the strategies in “The Young Millionaire“ not just theoretical but tangible. These real-world examples help demystify the process of wealth-building and offer proof that the methods described in the book work. For aspiring millionaires, seeing others succeed can be the motivation needed to start their own journey toward financial freedom. By sharing a wide range of success stories, Butogwa shows that anyone, no matter their background, can achieve financial success with the right mindset and approach.

Applying “The Young Millionaire” to Your Life

One of the greatest strengths of “The Young Millionaire“ by Daniel Butogwa is its focus on actionable advice. It’s not just a book that shares theoretical concepts; it provides readers with concrete steps to implement immediately in their own lives. The strategies outlined can be adapted to different financial goals, whether you are just starting your career or looking to scale an existing business.

Butogwa’s approach emphasizes creating multiple streams of income, which is a critical concept for anyone aiming for financial independence. The book guides readers through identifying potential income sources, such as side hustles, online businesses, and investments. Applying this advice in your life could involve starting a small e-commerce venture, creating digital content, or exploring ways to invest in stocks, real estate, or peer-to-peer lending. By diversifying your sources of income, you can create financial stability and build wealth faster.

Additionally, Butogwa stresses the importance of a growth mindset. By focusing on continuous learning, networking, and embracing failure as a stepping stone, you can overcome challenges and push through tough times. He encourages readers to use setbacks as lessons, showing that success is rarely linear. The lessons from “The Young Millionaire“ can inspire you to take risks, fail forward, and keep improving your financial literacy.

By breaking down the steps to becoming a millionaire into digestible chunks, “The Young Millionaire“ offers clear guidance on how to stay disciplined, be strategic, and ultimately reach financial freedom. Whether it’s setting SMART financial goals, automating savings, or learning to invest intelligently, applying these strategies can dramatically change your financial trajectory.

For anyone looking to take their first steps toward wealth, applying the concepts in this book can set you on the path to success, making it not just a guide to read, but a blueprint to follow.

Conclusion

Incorporating the lessons from books on how to become a millionaire can significantly boost your financial literacy and help you develop a wealth-building strategy that works for you. Whether you’re just starting or looking to refine your approach, books like “The Young Millionaire“ provide practical advice, success stories, and a roadmap to financial freedom. With the right mindset and consistent effort, anyone can achieve their wealth-building goals. Start reading, take action, and begin your journey to financial independence today.